Does Homeowners Insurance Cover Fire?

June 3, 2024

Does Homeowners Insurance Cover Fire? When you buy a house, you’ll need home insurance to protect it against a range of unexpected events that could cause damage. In most cases, your homeowner’s insurance policy will pay repairs if your home is damaged in a fire. However, if you live in a high-risk area for fire destruction, you may need to acquire a separate wildfire insurance policy.

Here’s a breakdown of what repairs your homeowner’s insurance likely covers in fire-prone areas to help you prepare for unforeseen wildfire damage and evaluate if you’ll need to acquire a separate wildfire insurance policy.

Also, Read: Benefits of Working with a Local Home Insurance Agent

In most cases, your homeowner’s insurance policy will cover fire damage, including wildfires. If your house is damaged by a wildfire, your policy will usually cover the cost of repairing or rebuilding your home and other structures. Temporary housing, replacement of items, and landscaping restoration may all be covered by some insurance policies. The cost and scope of coverage, however, might vary depending on the policy and the wildfire risk in your area.

Also Read: What Is the Legal Description of Property?

Your belongings are covered under personal property coverage. Appliances, furniture, art, clothing, recreational equipment, tools, and electronics, among other things, may be covered by your insurance policy. The limits for this policy are typically set at 50% to 70% of your home coverage.

Other structures coverage allows you to replace items that aren’t related to your home. Sheds, fences, and a detached garage are examples of these. Typically, this coverage is determined as a percentage of your housing coverage. For example, if your other structures coverage is set at 10% of your dwelling coverage and you have $350,000 in dwelling coverage, your other structures coverage is limited to $35,000. If you’ve recently added any structures to your property, such as an in-ground pool or gazebo, it’s a good idea to examine and renew your policy to ensure you have appropriate coverage.

Dwelling coverage, coverage for other structures on the property, and personal property coverage are the three types of coverage provided by homeowner’s insurance. Here’s what you might be insured for if your policy includes fire damage coverage:

Dwelling coverage normally covers the cost of replacing or rebuilding the home’s physical structure as well as any associated structures such as a garage or deck. Your policy will set restrictions on how much it will pay to rebuild your complete house, based on a formula that takes into account materials and labor costs in your area. Keep in mind that labor prices have just risen dramatically. As a result, it’s a good idea to double-check your policy to make sure you’re covered at the current labor and material rates in your location.

Your property’s trees, shrubs, plants, and lawn may be covered by your homeowner’s insurance. If your insurance includes landscaping coverage, it usually covers a proportion of the value of your home. For example, if you have 10% coverage for these items and $175,000 in dwelling coverage, you may replace your landscape for up to $35,000. Because coverage frequently has limits, it’s wise to find out exactly what your policy covers.

Additional living expenses coverage may be included if you experience “loss of use” as a result of being unable to remain in your house due to wildfire damage. This coverage may pay for expenses such as a hotel stay, pet boarding, restaurant bills, and even laundry services, depending on your insurance. This coverage may also apply if local authorities order you to evacuate.

While many homeowner’s insurance policies cover fire damage, this may be contingent on your area’s fire risk. Some insurance companies may raise deductibles, charge higher rates, reduce payments, or refuse to provide coverage to residences in high-risk zones. You’ll need to obtain a separate wildfire insurance policy if your insurance company refuses to cover fire damage.

If you’re seeking wildfire insurance, you might be able to get coverage from a premier carrier. Homeowners who have been denied coverage by a traditional house insurance company might turn to surplus line carriers for help. Surplus line policies are typically more expensive than standard homeowner’s insurance.

Also Read:: How to Buy Your First Rental Property

For residences worth more than $1 million in high-risk fire locations, premier carriers typically offer insurance policies. Loss prevention and private firefighting services are usually included in this insurance. Surplus line or premier carriers may be the best option for protecting your house if you require wildfire insurance.

If you can’t get homes insurance in your neighborhood, your state’s Fair Access to Insurance Requirements Plan may be able to help. The FAIR plan provides insurance to homeowners in high-risk areas who are unable to obtain normal homeowner’s insurance. Keep in mind that FAIR insurance policies are not always less expensive than standard homeowner’s insurance, and they often have fewer benefits.

Related Articles:

How can I get a cheap rental on my next lease? Renting a house or apartment can be costly. The good news is that in some cases, you may be able to negotiate a lower rent.

There are times when it’s appropriate to ask for a lower rent, from shifting rental costs to market trends and even pandemics that affect a large number of people.

Whether you’re thinking of asking your current or potential landlord for a lower rent, you should be prepared with research and a strategy to maximize your chances of success.

It’s worth noting that if you make an offer to a real estate agent to negotiate a lower rent, the agency is obligated to present it to the landlord for review and a decision.

If you’re thinking of asking for a lower rent, like anything else in life, it’s best to be prepared, do your homework, and go in with a strategy.

Here are some things to think about before asking for a lower rent.

If you’re going to ask for a lower rent, make sure you’ve prepared yourself with evidence to back up your claim. This could include demonstrating that similar properties in the area are available at lower costs, demonstrating that prices have been declining in the area, or researching the percentage of unoccupied properties in your area.

If the home has been on the rental market for a long time, you may want to keep track of it and present evidence of it – this may give you some negotiation power.

Ask yourself how far you’re willing to go before you start negotiating. Are you willing to break your lease early and go elsewhere if your landlord does not fulfill your price expectations? If that’s the case, go over your lease agreement first.

You don’t want to jeopardize your bond by breaking a lease, which might cost thousands of dollars. Before jumping ship, it’s crucial to know how much money is on the line (or threatening to).

It is possible to end your lease early if you and your landlord reach an agreement first. If this is the case, make sure to have any liability or cost agreements in writing.

After you’ve done your research and double-checked your rental agreement (if you’re approaching a current rather than a possible landlord), you’ll need to figure out how you’ll approach them and what you’ll ask for.

If a face-to-face meeting isn’t possible, you might write a letter or arrange a video call. Either choice is acceptable.

Then make sure you walk in with a certain discount in mind, research to back up that discount, and a list of what you’re willing to negotiate on. For example, if you agree to sign a longer lease, your landlord may agree to the discount. Prepare for this and decide where you are willing to make concessions before approaching the request.

how to write a letter requesting a rent decrease

The next stage in negotiating a lower rent is to send an email, as formal requests for changes to the lease agreement must be made in writing.

Your property management or landlord may prefer to talk over the phone about the matter, but it’s ideal to have the request in writing in case you need it later.

Here’s how to write a letter to your landlord requesting a lower rent:

If COVID has had a financial impact on you,

If COVID has had an impact on your money, this should be the primary subject of the letter.

You’ll need to write down the following details:

100% Free Instant Moving Quotes! America’s Most Reliable and Affordable Long-Distance or Local Movers at WOW MOVER

Related Articles:

Property Line Dispute: Encroachment is described as any situation in which one person uses or constructs on another’s land. Typically, such conflicts arise when property boundaries are not clearly described or apparent between adjacent properties.

On the surface, encroachment seems to be a simple concept to understand. The basic legal meaning is easy to understand.

In fact, encroachment is much more complicated than this simple description. Here’s what you need to hear about it.

Encroachment disputes are almost as old as human society. We’ve had disagreements about such distinctions for as long as we’ve had definitions of “my property” and “your land”.

Fortunately, you don’t have to use a small army to protect your private land. However, it’s important to recognize that encroachment can take many forms.

Here are a few examples of encroachment problems you might run into:

Also Read: What Is the Legal Description of Property?

It shouldn’t take much creativity to see how someone exploiting their easy access to an easement will make life difficult for a homeowner. Easements and encroachments are not the same thing. The former is, by definition, unagreed upon. Yes, if the situation calls for it, an easement may be a viable alternative to a possible encroachment.

You have choices for dealing with encroachment. They don’t have to all end up in court.

Although there are times that it is appropriate to seek legal recourse, de-escalating the dispute is always a more direct way of resolving the underlying issue.

The following are some possible encroachment solutions. Please keep in mind that these are just some of the options available to you. Whatever is best for you should be discussed with a trusted attorney.

Also Read: Tips For First-Time Landlords

Approaches to dealing with encroachment include:

Don’t be hesitant to ask for help. If you’re being suspected of encroachment or think your land has been encroached upon, now isn’t the time and try to act as your own lawyer. Major real estate disputes are valid reasons to seek the advice of a competent real estate attorney about your situation and next steps.

Related Articles:

Summer is a season of relaxation and fun. Families also spend more time outside enjoying the warm weather or going to the beach for a much-needed break. But according to new statistics from U.S. Census Bureau, a high number of families currently prefer moving during summer. As it turns out, the three months between Memorial Day and Labor Day are a common time to relocate for several reasons.

Although moving in the heat of summer might sound like a terrible alternative to taking a beach holiday, it’s actually a good option for many movers. Here are the top reasons why so many people want to plan their move over the summer.

Summer is a big season for most real estate agents since both inventory and sales peak dramatically. The inventory of houses accessible in July is about 25 percent higher than in December. This dynamic is particularly true in cities with warmer climates, like Orlando or San Diego.

With more inventory available, people who move over the summer will have more options to choose from if they’re looking to buy a house. Because summer is a common time to move, anyone looking to sell their home will also be able to find buyers more easily in the summer than at other times of the year. The busier real estate market is a huge advantage of moving in the summertime if you are trying to purchase or sell a house.

Most students enjoy a long summer break from classes. This means families of school-age children will expect to travel over their break to avoid affecting their school year. Parents who plan a summer transfer eliminate the fear of their kids missing school due to the moving process. As a bonus, kids on summer break can use their spare time to help their parents prepare and get stuff ready for the move.

Also Read: How To Prepare For A Residential Moving

A summertime change also makes sense for working individuals, too. Many employers are more accommodating with time-off demands over the summer. Some businesses also have shortened working hours during the summer months. These workplace practices can be a big help to workers who are planning a transfer.

Traveling during the summer means warmer temperatures, which can result in a hot and sweaty packing phase. However, the sunny summer weather reduces many of the dangerous road conditions that can arise during fall and winter. In certain places, the cold weather months will bring high winds, heavy rain, snowstorms, and icy highways, all of which can slow the moving process and trigger transit problems.

Daylight Savings Time (in most states) means longer days during the summer. Anyone who’s going through the moving process would surely enjoy getting a few extra hours of daylight to get things done!

The good weather, open schedules, and busy real estate season make summer the ideal time to travel and move. If you’re contemplating a summer move, it’s best to reserve your preferred moving dates as soon as possible—this is a busy time of year for moving companies!

Schedule your free in-home estimate today to get started

Related Articles:

How to Downsize into a Smaller House?: Regardless of whether you’re moving from a palatial or a castle-like estate to a midtown condo or you’re moving in with a significant other, cutting back or downsizing is altogether.

Moving from an enormous home brimming with your stuff to a little space can be dubious, and keeping in mind that it’s anything but difficult to say that it is simply disposed of your additional stuff, doing it is a lot harder.

Here are the means by which to make the change as smooth as could reasonably be expected.

In case you’re moving into a little space with another person and consolidating household units, this progression is considerably significant, for you, but for the individual you’re moving in with too. go through your inventories together.

Be savage with your rundowns, as well—it’s regularly said that the things you own grow to occupy the space you live in, however the opposite, that they contract to fit pleasantly, never occurs.

Before you do anything—before you even move and know how much space you need to move into, the principal activity is to take a close inventory of your effects. Ask yourself, If all that you possessed was lost in a fire-related accident, what might you replace?

Assess the things that are really critical to you, and the things that you could live without, or could really replace or scale down alongside your living space.

Preferably, you’ll make three records: Must-haves, can live without, and things I could replace, and go from that point. Additionally, taking full stock of your things is an extraordinary method to make a point by making a detailed home inventory, for that tenant’s or mortgage holder’s insurance.

We referenced that in case you’re moving into a little space with somebody, ensuring you go over your inventories together is fundamental. The exact opposite thing you need to do when attempting to join two household units is to discover that you’ve both brought two full arrangements of dishes, flatware, glasses, or more regrettable, enormous things like seats, lounge chairs, work areas, etc.

Also Read: 5 Moving Risks You Should Be Aware Of When Moving To New Places

This is the place it’s significant to have a home inventory close by before you move, and that you both sit down and settle on choices on the things you need to keep, who brings the dishes and who brings the glasses, who brings the bed and who brings the seats.

The following stage is to leave behind those things that you don’t need and sell them for money. The more cash you make, the more you’ll have the option to purchase things that are size suitable for your new home or set aside the cash and make the most of your new life in your little space.

Additionally, consider a portion of the things you own that are simply “insurance” items. For instance, additional sleeping mattress in the carport, or the futon in the storm cellar—those things you save for no reason other than the chance of something you do utilize each day breaking.

Those are the prime possibility to sell: The things you’re keeping are just devaluing in esteem. You’ll help yourself out by reserving the cash you get from them in a bank account and purchasing a lounge chair or a futon in the event that you ever need one as opposed to clutching an old, smelly one in the event of some unforeseen issue.

At last, whatever you do, in the event that you can’t sell it, don’t spare a moment to give it to a noble cause or to a charity. On the off chance that you can’t utilize it and it’s in acceptable condition, another person will, and they’ll welcome it.

Scaling down doesn’t need to be a problem, it might seem like it, and leaving behind the things you own can be emotional yet attempt to consider the existence you’ll get in return for the messiness you’re parting with.

Related Articles:

At the point when you’re apartment hunting, your emphasis is commonly on finding an incredible new spot in a neighborhood you like. While you may not be watching out for apartment rental scams, keeping your eyes open for a potential fraudster is to your greatest advantage. In case you’re searching for your next rental home, these tips may assist you with spotting and maintaining a strategic distance from common rental scams.

One common apartment rental scams are for somebody to play off an empty property, frequently a getaway or vacation home, or one that is bank-bank-owned, as their rental property. At the point when it comes time for you to look the place over, they’re out of nowhere wiped out, sick, out of town, or won’t give you the location. Be extra mindful if they request a lease or a security deposit in spite of not appearing to meet you.

Also Read: The Easiest Way To Help You Find The Perfect Apartment

A decent landowner or property manager will show you the apartment, regardless of whether it implies rescheduling for one more day or having a partner take you through the property. You should never sign a rent without seeing a rental. On the off chance that you can’t go see it in person yourself, which may occur if it’s a significant distance move, have a companion or relative you trust in a stroll through the rental property.

In the event that you haven’t seen the place let alone signed a lease, there is no requirement for you to give the landlord cash. In case you’re approached to pay upfront, You should leave. Be particularly cautious if a landowner demands a wire transfer, as it’s extremely hard to stop an installment that is wired — which is the thing that the scammer is relying on.

In the event that you discover a place with rent that is well below different apartments in the location, This might be a sign of a fake posting. It’s normal for apartment rental scammers to copy and past from a real posting into a false one with a low rental cost. This rental scam is frequently coordinated toward individuals who are moving from out of town and other people who put money down without any inspection since it would seem that such a decent arrangement. There is an opportunity it’s the real deal, however, continue with caution.

When you apply for a rental home, you’ll likely be requested for monetary information and work confirmation and verification, and the proprietor may do an individual verification. Along these lines, if a proprietor or property manager doesn’t do a lot of screening or is excessively ready to arrange the rent with you, it might be cause for concern. Scammers will in general need to surge the procedure, with the goal that you’re pulled in before you understand something isn’t right. Along these lines, in case you’re feeling pressured by an excessively energetic landowner, you might need to leave.

Also Read: How to Make a Financial Plan for Your First Apartment

Avoid listings that are loaded with grammatical errors — a spelling error here isn’t caused for concern, yet landowners and property managers will probably edit a posting before it is distributed and published, so a posting with various blunders is a warning.

Try not to give out personal information upfront — there is no compelling reason to give money-related data or your Social Security number while you’re still looking for a rental.

Looking through the property’s location on the internet — this may show likely issues, for example, regardless of whether a property is in foreclosure or that the alleged landowner is truly not the proprietor.

Follow your instincts and leave a circumstance that doesn’t appear to be correct or when you’re getting forced. Knowing a few indications of potential rental scams can assist you with abstaining from being exploited as you pick your new home.

Related Articles:

Need to rent an apartment? Moving across the country, or even just a few states, might be exciting — a new beginning! — but it can also be a logistical nightmare when it comes to finding an apartment. How can you know if the pictures aren’t deceiving and that supposedly beautiful building isn’t actually just across the street from the sewage treatment plant? There are a few ideas and tips to help you find an apartment out of state if you’re preparing to take the plunge blindly.

Related

The Most Effective Ways on How to Negotiate Rent

If you receive a relocation package, the HR department at your new employer will have the right information for you on how to find an apartment out of state, and you may even receive aid with the search if you ask – so don’t forget to ask. They may have a regular real estate broker or someone who is willing to go see your potential apartment for you if you are unable to do it yourself. They understand that renting an apartment without first viewing it is dangerous, and they want you to have a smooth transition.

Also Read: Question To Ask Before Renting An Apartment

Have all of your documents ready to go, as many landlords and management companies want a current pay stub, references, bank statements, and a deposit. Make sure you know how to make a bank transfer, or be prepared to send a check with your deposit by certified mail. Being the first in line when renting an apartment out of state can be difficult, and some of the greatest apartments go quickly, so you don’t want to lose out!

Are you opposed to living on the ground floor or do you require a lot of light and windows? What about allowing you to paint or having a bathtub rather than a walk-in shower? Make a list of the features you want in your new apartment before you start apartment-searching in another state.

You’ve probably seen the Google cars with cameras installed on them driving around, right? There’s a good chance that a street view of your possible home is available. Do a 360-degree rotation once you’re virtually in front of the building to view what’s next door and across the street. This will give you a solid overview of the general area and alert you to anything that needs more investigation, such as safety, public transportation accessibility, or the availability of amenities like grocery stores. Learn more About Google Street View

The Better Business Bureau lists most big management businesses and large apartment building landlords that can help you find them. When you’re looking for an apartment in a place you’ve never visited, you don’t have the luxury of friends who almost certainly know someone who has, so it’s best to do your research online. Just keep in mind that there will always be a few angry tenants; look for patterns rather than outliers.

If your apartment search in another state isn’t going well, try securing a short-term lease or sublet to get you settled, and then do a more thorough apartment search once you’ve arrived. When you discover the perfect apartment, make sure you have your new apartment checklist ready so you can get settled in fast and easily.

So you found a fantastic apartment, but it’s a tad smaller than you’re used to? Take a look at Ikea furniture hacks online for small apartments for some great ideas on how to make the most of your space.

Related Articles:

How to make your transition a bit easier for everybody? Moving can be exciting but it can be hard on you, not to mention your relatives. here’s a way to make the transition a bit easier on everybody including your lovely pets.

A transition for kids and Moving may be disturbing for children; it may be frightening and they have little control over the choices made. so get them excited and settled in with these tips:

Now and then, another environment can be somewhat hard for a pet, however. To your pet, a move can be an abnormal and new experience.so prepare with them transition with the following:

Now that the hardest part of your move is over. Now it’s time to enjoy setting up your space and getting to know your new home.

It would be hard decision-making and life-changing events when it comes to moving from old to a new ones. Especially if they have sentimental value on it, you would just analyze the options that you can get about it, the cost and hardship to start a new one again. If it involves a house move, just the kind of difficult.

Based on a recent survey according to a study by the U.S. Census Bureau Study, out of 50% of people move because their old home no longer suits or preferences.

Home is too small -when we are young our world is big, but when getting older the bigger space we need, Adulthood is one of the factors or fulfilling our dreams.

The chance to save some money on household expenses is another major reason to move to a different house – be it to a new home in a cheaper area or to a more easily affordable home in the same city. Lower taxes, insurance rates, utility bills, and/or cheaper overall cost of living (food, transportation, healthcare, home maintenance costs, etc.) can make a big financial difference and reduce much of the stress and frustration that come with a tight budget.

While living in a rented property can be the best option for young people who have not yet found a stable job, started a family, or decided where they want to live, as well as for people who need temporary living accommodations, it is not a suitable long-term housing solution. Homeownership comes with a great number of responsibilities but it provides a lot of wonderful opportunities as well – a chance to create the home of your dreams, freedom to enjoy the lifestyle you’ve always wanted, greater peace of mind…

Related : Top 5 Best Interstate Movers and Storage Companies

So, when people settle in life and save enough money to afford to buy their own house or apartment, they usually start searching for an appropriate new home and move out of their last rental property as soon as they find a place that suits their needs, preferences, and available budget they move quickly.

As professional a lot of aspects bothers us the most especially it comes with safety and is time-consuming. Living in an area with better infrastructure, abundant local amenities, easier access to quality medical care, educational institutions, recreational centers, entertainment venues, etc. Some Families often choose to move to safer, calmer, better-kept, child-friendly neighborhoods with plenty of green areas, playgrounds, hobby clubs, etc., so that they can ensure the well-being of their young children and their own peaceful and enjoyable living. Having frequent problems and conflict with people next door may be good to leave unlike spider-man your friendly neighborhood.

Getting married or getting a life with your partners, but the worst is separating from each other- are the second most common reason for moving interstate or house. Newlyweds move in together to start their family and established their own household. They either move into an entirely new home or one of the spouses moves into their partner’s property.

Getting a new job in a different area or getting a scholarship program from a prestigious university. Relocating for a new job is one of the most frequent reasons to move to a new city. Especially with the opportunity for career advancement, higher salary, stable job, better work conditions, etc., most people are quite willing to move as far away as necessary(be it halfway across the country)to grasp that chance.

Employees can be sent to a different city or state with a specific long-term assignment or can be required to relocate to a different branch of the company they are working for. Companies may relocate to another city or state in an attempt to improve their business opportunities or cut down overhead costs.

Being positive can make your transition faster. Some reasons why you are moving out is you are downsizing or you can afford the rent anymore. Downsizing will allow you to get rid of stuff you don’t need anymore, and moving can help you financially and meet new friends. Focus on positive signs in every transition, sure your life will feel better.

Related Articles:

The process of looking for and buying a new home can be both exciting and nerve-racking. If this is your first time purchasing a home, those emotions may be amplified. You’ll want to make sure you have everything you need so that you can deal with any situation that may arise. This is why you should be aware that the list price of the home you’ve chosen is not the total amount you’ll pay. There are a few hidden costs to be aware of before signing the paperwork. Knowing those costs ahead of time will make it easier to be excited on closing day.

Here are a few things to keep in mind:

One of the most significant advantages of living in a rental property is that if something breaks or malfunctions, you simply contact your landlord. They will also handle landscaping tasks such as snow removal and lawn cleanup. When purchasing a new home, it is always a good idea to have a home inspection performed. You’ll have a better idea of what you’re getting yourself into this way. You may also want to set aside money for maintenance and repairs, which are unavoidable when you own your own home.

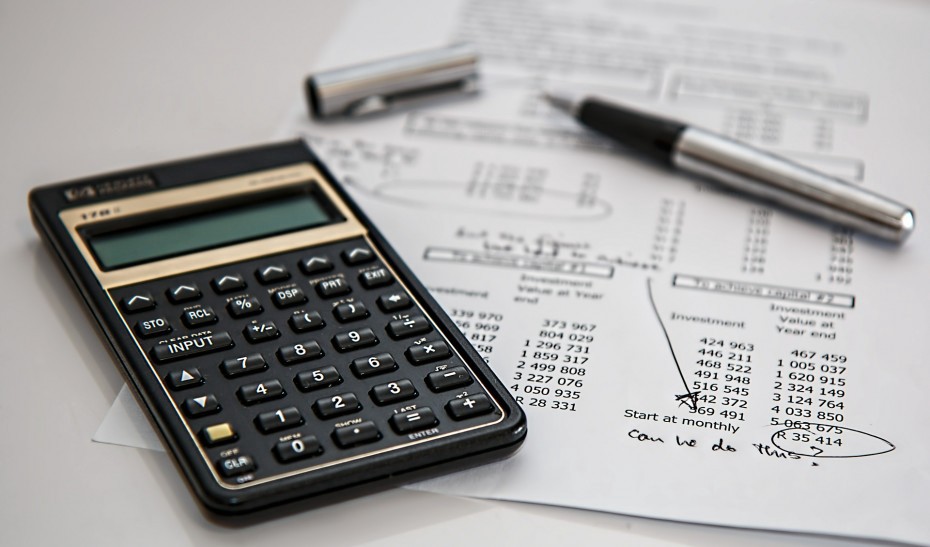

Every house is unique. The cost of utilities varies depending on the size of the home, its location, and the types of utilities it requires. The average home spends about $111 per month on electricity. When compared to a two-bedroom apartment that costs $30 to $50 per month, this can quickly add up. It goes without saying that the larger your living space, the higher your energy bills will be. When you’re in the process of buying a new home, it’s easy to overlook this detail. But don’t let that stop you from being excited. Simply take this into account when calculating your overall budget.

Most of us have heard of closing costs, but what exactly are they? These fees can include a variety of items and vary from home to home. Closing costs, for the most part, refer to lender fees, a down payment on home insurance, miscellaneous taxes, and title insurance. These are the most common causes of closing costs, but they may vary depending on your specific situation. In general, closing costs will range between 2% and 5% of the home’s value.

Mortgage companies will not lend you money unless they take their own safety precautions. They will charge you interest in order to reduce their risk in trusting you to pay your mortgage accurately and on time. This is an additional expense that will be added to your monthly payments. Mortgage interest rates vary depending on your credit, but on a 30-year fixed-rate mortgage, you can expect to pay anywhere from 3% to 8%.

Also Read: Rental: Tips for First-Time Landlords

Though it varies by state, the average American will pay more than $2,000 in property taxes per year. However, in some states, such as New York, you will pay even more, which is close to $7,000 per year on average. This is definitely something you’ll want to think about when looking to buy your new home, and it’s often overlooked when you’re a first-time homebuyer.

Property taxes are typically included in your monthly mortgage payment, making them easier to manage. However, in addition to other lumped-in fees, property taxes will increase your monthly payment and may increase year over year. This is important to keep in mind when deciding how much money to spend on the list price.

Buying a new home necessitates time and research. You’ll want to make certain that you’re making the right decision when purchasing the home of your dreams. WowMover will be there to help with your moving stress when you finally put in that home offer, even if the decision is yours and yours alone.

Related Articles:

Home staging is a valuable marketing tool for home sellers. By emphasizing the property’s finer aspects and reducing faults, a staged home builds an emotional connection with potential buyers. Purchasers may envision themselves living in the home, resulting in a larger pool of possible buyers and a shorter time on the market.

Staging your property, on the other hand, is a financial investment. Certainly, the return on investment (ROI) must be worthwhile. Our guide to home staging costs includes important facts to consider as you work to make your home show-worthy.

Related

Household Problems To Fix Before Moving Into A New House

House Hunting Tips for Moving Out of State

Things You Should Know About Your House Down Payment

Do you want to know how much it costs to stage a home? Consider how quickly comparable houses in your region sold, their condition, and how long they were on the market when deciding on home staging.

According to the National Association of Realtors (NAR), the average cost is $400. The cost of home staging varies greatly depending on the local market and the services used. The national average spends for consultation, organization, and redesign of three rooms was $1,500, according to a Fixr survey.

Planning to move?

Here are the best moving companies you can trust;

Xfinity Moving

College Hunk

Two Men and a Truck

All My Sons Moving and Storage

U-Haul

College Hunk

Portable On Demands

Budget Truck Rental

1-800-PACK-RAT

Penske

Best Interstate Moving + Storage

The cost of house staging is determined by a number of factors. Keep the following factors in mind as you plan your home staging budget.

Consultation

The goal of a home stager is to objectively assess your house’s current overall condition and advise you on the best upgrades to make in order to maximize resale value. A comprehensive property appraisal and a detailed description of suggested repairs, design, and furniture improvements, and paint colors are frequently included in the initial consultation.

Your house’s condition

The status of your home, first and foremost, will determine your personal home staging charges. Is your home, for example, tidy or cluttered? Is the house empty or occupied by the owner? Are your home’s repairs current? Your customized home staging path will be put in motion by the modifications you choose to make based on your stager’s recommendations.

Is it better to restyle your furniture or rent it?

The cost of house staging is determined by the style of your home. If you choose a restyle, your home will be staged using the furnishings and accessories you already have. Part sellers, on the other hand, choose to remove some or all of their current belongings to create a way for rented furniture.

Organizing and decluttering

During your home staging consultation, you’ll get advice on how to get your house ready to sell. Cleaning and organizing rooms may be a part of that preparation. You can do it yourself or hire a staging firm to do it for you.

Style, delivery, and installation

To achieve a consistent look, styling is an important aspect of the staging process. Consult your home stager on the cost of key room decorating versus a full home makeover. The cost of renting and installing furniture and decor in your home will affect your home staging budget. The bottom line is that the more resources you need to stage your property, the more money you’ll spend.

Photography by a professional

A well-staged property must be able to transition to virtual listings. Professional photography comes into play. After the change is complete, some home staging businesses offer photographic packages that include a professional photo shoot. These images can be utilized in virtual listings and other forms of marketing.

Lease agreement

When you rent furniture, artwork, or accessories to stage your house, you’ll usually be required to sign a contract that specifies a minimum rental duration. This could be on a monthly basis or more, and it will need to be factored into your research into “how much to stage a house.”

Related Articles: